Paycheck tax calculator mn

Illinois tax year starts from July 01 the year before to June 30 the current year. Physical Exam Information MN PS171S.

Minnesota Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Wisconsins maximum marginal income tax rate is the 1st highest in the United States ranking directly.

. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Switch to Minnesota salary calculator. This Minnesota hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. Payroll management made easy. Benefits Inquiry MN PS110S.

Wisconsin collects a state income tax at a maximum marginal tax rate of spread across tax brackets. North Carolina tax year starts from July 01 the year before to June 30 the current year. Calculating your Indiana state income tax is similar to the steps we listed on our Federal.

Your Yearly Tax Savings. Direct Deposit MN PS310S. Calculate your Minnesota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

Using our retirement calculator. Calculating your North Carolina state income tax is similar to the steps we listed on our Federal paycheck calculator. Its median household income is also among the highest in America at 80776 2017.

Self-Employed defined as a return with a Schedule CC-EZ tax form. So the tax year 2022 will start from July 01 2021 to June 30 2022. 1 online tax filing solution for self-employed.

Arizona tax year starts from July 01 the year before to June 30 the current year. Minnesota Salary Paycheck Calculator. The state tax year is also 12 months but it differs from state to state.

Figure out your filing status. So the tax year 2022 will start from July 01 2021 to June 30 2022. Federal taxes are progressive.

Correcting HR Data MN PS155S. Texas state income tax. Minnesota tax year starts from July 01 the year before to June 30 the current year.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. Like the Federal Income Tax Wisconsins income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Calculating your Arizona state income tax is similar to the steps we listed on our Federal.

Calculating your Washington state income tax is similar to the steps we listed on our Federal paycheck calculator. Employee Business Expense MN PS400S. Figure out your filing status.

Americas 1 tax preparation provider. So the tax year 2022 will start from July 01 2021 to June 30 2022. Small Business Low-Priced Payroll Service.

The charts below show the potential tax savings that you could miss out on by waiting. 401k Savings with Profit Sharing. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Indiana tax year starts from July 01 the year before to June 30 the current year. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. Mass Time Entry and Labor Distribution MN PS320S.

New Jersey tax year starts from July 01 the year before to June 30 the current year. So the tax year 2022 will start from July 01 2021 to June 30 2022. Leave Accounting MN PS350S.

Calculating your Tennessee state income tax is similar to the steps we listed on our Federal paycheck calculator. Sell Open Sell sub-menu. Texas tax year starts from July 01 the year before to June 30 the current year.

Fast easy accurate payroll and tax so you save time and money. Copy and paste this code into your website. Find out how easy it is to manage your payroll today.

Calculating your Arkansas state income tax is similar to the steps we listed on our Federal. So the tax year 2022 will start from July 01 2021 to June 30 2022. Maryland state has a population of a little over 6 million 2019 and is a major historic trading port and birthplace of the national anthem.

Figure out your filing status. 401k Contribution Effects on Your Paycheck Calculator. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

Free for personal use. Figure out your filing status. Arkansas tax year starts from July 01 the year before to June 30 the current year.

Massachusetts tax year starts from July 01 the year before to June 30 the current year. So the tax year 2022 will start from July 01 2021 to June 30 2022. Some states follow the federal tax year some states start on July 01 and end on Jun 30.

This is tax withholding. So the tax year 2021 will start from July 01 2020 to June 30 2021. Employee Maintenance MN PS150S.

Your Take Home Pay Only Changes By. So the tax year 2022 will start from July 01 2021 to June 30 2022. Similar to the tax year federal income tax rates are different from each state.

Manage labor costs and compliance with easy Time Attendance tools. You must file a joint tax return and one spouse needs to have owned the property for a minimum of five years with both spouses living in the house for two of the last five years. Start Free Trial Log.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Contributions Affect Your Paycheck. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

Use this calculator to see how increasing your contributions to a 401k plan can affect your paycheck as well as your retirement. See how your withholding affects your refund take-home pay or. Follow the steps below to calculate your take home pay after state income tax.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The other major advantage of a 401k plan is the tax savings from pre-tax contributions. Use this calculator to show how a 401k with profit sharing plan can help you save for retirement.

Figure out your filing status. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Washington tax year starts from July 01 the year before to June 30 the current year.

3 Months Free Trial. Labor Relations MN PS180S. Tennessee tax year starts from July 01 the year before to June 30 the current year.

Starting as Low as 6Month. Calculating your Illinois state income tax is similar to the steps we listed on our Federal.

Minnesota Income Tax Calculator Smartasset

Minnesota State Income Tax Mn Tax Calculator Community Tax

Minnesota State Income Tax Mn Tax Calculator Community Tax

Frontline Worker Pay Afscme Union Hall

Minnesota Paycheck Calculator Tax Year 2022

Minnesota Requirements For Form W 2

Minnesota State Income Tax Mn Tax Calculator Community Tax

2

Hennepin County Mn Property Tax Calculator Smartasset

Minnesota State Income Tax Mn Tax Calculator Community Tax

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Minnesota Paycheck Calculator Smartasset

Weekly Paycheck But Monthly Bills Here S How To Budget Budgeting Budgeting Finances Paycheck

Minnesota Requirements For Form W 2

Radiologist Salary In Minneapolis Mn Comparably

Minnesota Paycheck Calculator Smartasset

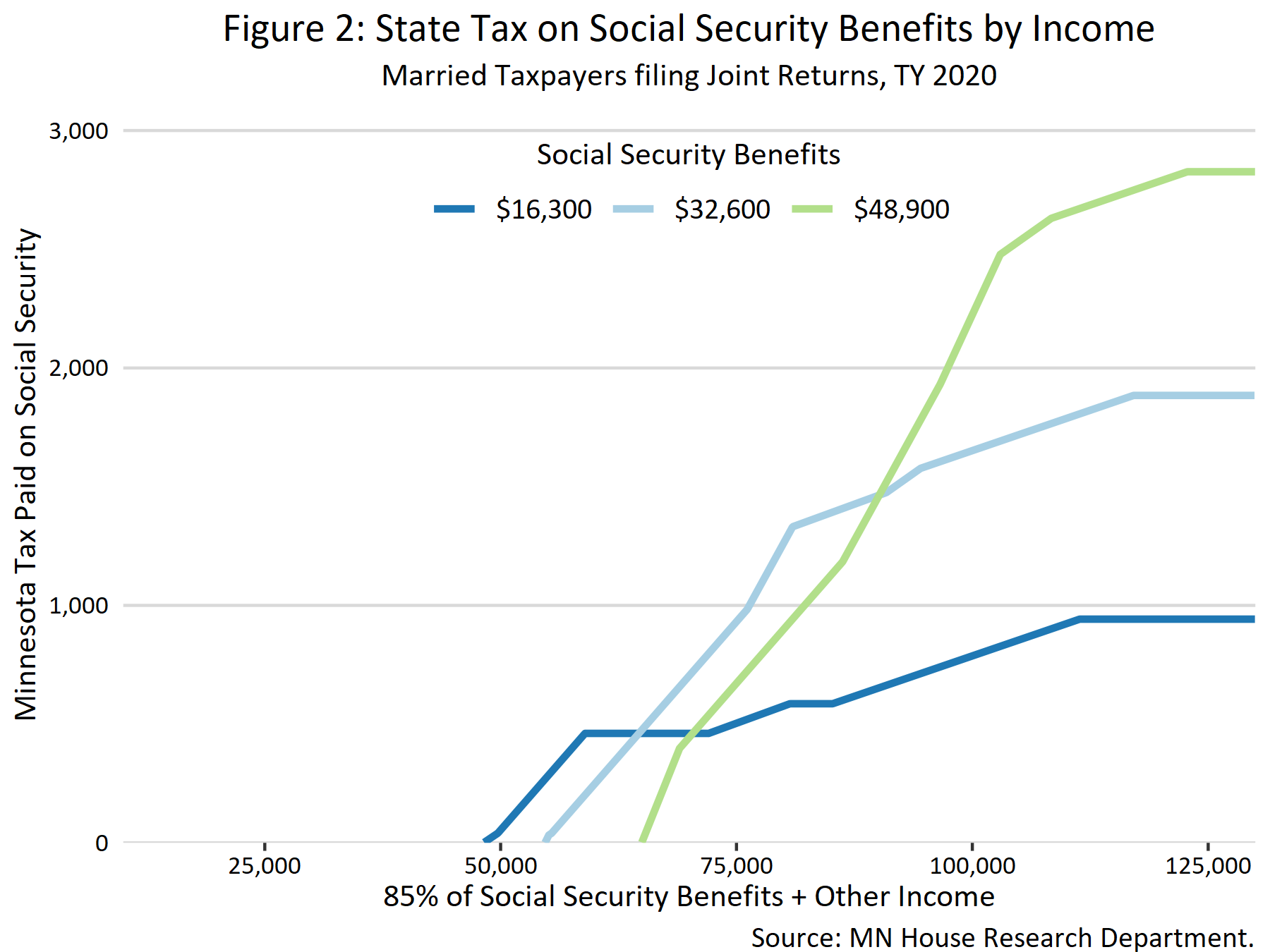

Taxation Of Social Security Benefits Mn House Research